Get This Report about Eb5 Immigrant Investor Program

The Eb5 Immigrant Investor Program Diaries

Table of ContentsWhat Does Eb5 Immigrant Investor Program Do?How Eb5 Immigrant Investor Program can Save You Time, Stress, and Money.The Of Eb5 Immigrant Investor ProgramThe 5-Minute Rule for Eb5 Immigrant Investor ProgramThe Only Guide to Eb5 Immigrant Investor ProgramFacts About Eb5 Immigrant Investor Program RevealedThe smart Trick of Eb5 Immigrant Investor Program That Nobody is Talking AboutThings about Eb5 Immigrant Investor Program

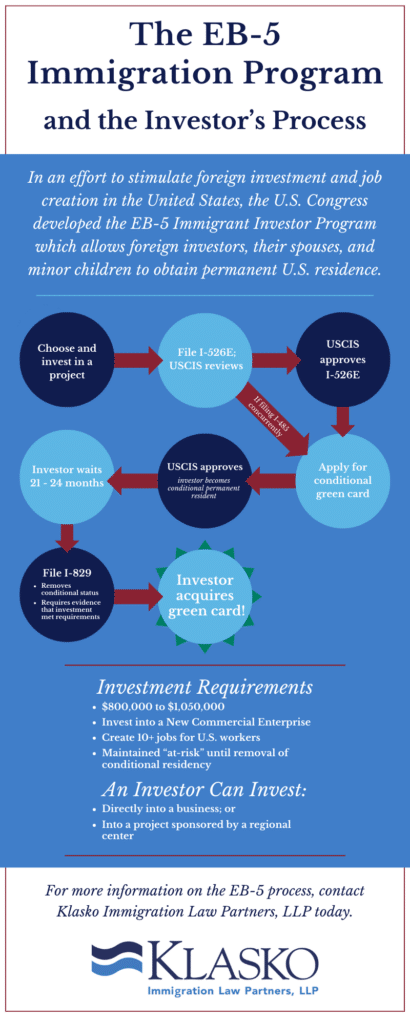

The financier should request conditional residency by sending an I-485 application. This petition should be sent within six months of the I-526 authorization and must consist of evidence that the investment was made which it has produced a minimum of 10 full-time jobs for U.S. workers. The USCIS will certainly evaluate the I-485 application and either accept it or request extra proof.Within 90 days of the conditional residency expiry date, the financier needs to send an I-829 petition to remove the conditions on their residency. This petition needs to include evidence that the investment was continual and that it produced at the very least 10 permanent work for united state workers. If the I-829 petition is approved, the investor and their household participants will be given permanent residency in the USA Contact us for more help regarding the application requirements.

Not known Details About Eb5 Immigrant Investor Program

dollar fair-market worth. The minimum quantity of capital required for the EB-5 visa program may be lowered from $1,050,000 to $800,000 if the investment is made in a business entity that lies in a targeted work area (TEA). To get the TEA classification, the EB-5 project have to either remain in a rural location or in a location that has high unemployment.

workers. These tasks have to be produced within both year duration after the investor has actually gotten their conditional long-term residency. Sometimes, -the investor has to have the ability to verify that their financial investment led to the creation of direct work for staff members who work straight within the commercial entity that got the financial investment.

Getting The Eb5 Immigrant Investor Program To Work

Regional centers carry out EB-5 tasks. It may be much more beneficial for a financier to purchase a local center-run project since the financier will certainly not need to separately establish the EB-5 projects. Infusion of 8500,000 as opposed to $1,050,000 is not as difficult. Financier has more control over daily operations.

Capitalists do not need to develop 10 work, but maintain 10 already existing positions. Organization is already troubled; therefore, the financier might plan on a much better deal. Capitalist has more control over daily procedures. Infusion of $800,000 rather than $1,050,000 is not as cumbersome. Gets rid of the 10 employee demand, enabling the investor to qualify without straight hiring 10 people.

Congress gives local facilities top concern, which might mean a quicker course to authorization for Kind I-526. Financiers do not require to develop 10 direct jobs, but his/her financial investment ought to create either 10 direct or indirect jobs.

The investor requires to show the creation of 10 tasks or possibly greater than 10 tasks if broadening an existing browse around these guys company. Risky due to the fact that service lies in a TEA. Must generally live in the same area as the enterprise. If organization folds within two year period, financier can shed all spent capital.

7 Easy Facts About Eb5 Immigrant Investor Program Described

If business folds within 2 year duration, capitalist can shed all invested capital. Investor needs to show that his/her financial investment creates either 10 direct or indirect tasks. EB5 Immigrant Investor Program.

Normally supplied a placement as a Minimal Responsibility Companion, so capitalist has no control over everyday operations. In addition, the basic companions of the regional center company usually benefit from investors' investments. Investor has the alternative of purchasing any type of sort of business anywhere in the united state Might not be as high-risk since investment is not made in an area of high unemployment or distress.

Eb5 Immigrant Investor Program - Questions

Congress offers local facilities top priority, straight from the source which can indicate a quicker path to authorization for Kind I-526. Financiers do not need to produce 10 direct work, but their investment should produce either 10 direct or indirect tasks.

If company folds within two year period, financier can lose all invested capital. The financier requires to show the development of 10 work or possibly more than 10 jobs if expanding an existing organization.

The capitalist requires to preserve 10 already existing workers for a duration of at the very least 2 years. If a capitalist likes to invest in a regional facility business, it may be better weblink to spend in one that only needs $800,000 in financial investment.

The Ultimate Guide To Eb5 Immigrant Investor Program

Investor requires to show that his/her financial investment produces either 10 direct or indirect tasks. Usually used a position as a Minimal Responsibility Partner, so investor has no control over daily procedures. Furthermore, the general partners of the local center firm usually profit from financiers' investments. To find out more regarding EB-5 visas and Regional Centers, visit our EB-5 dedicated web site or contact Immigration Solutions LLC..

The 6-Second Trick For Eb5 Immigrant Investor Program

Let's damage it down. The is an existing investment-based migration program created to stimulate the united state economic climate. Developed in 1990, it gives international capitalists a if they satisfy the complying with standards: Minimum of $800,000 in a Targeted Work Location (TEA) or $1. EB5 Immigrant Investor Program.05 million in various other areas. The financial investment needs to create or maintain at the very least 10 full-time jobs for U.S.

Funds should be positioned in a company venture, either through direct financial investment or a Regional Facility. Many EB-5 tasks provide a roi, though profits can differ. Investors can actively take part in the united state economic climate, profiting from possible business development while safeguarding a pathway to united state long-term residency. Reported in February 2025, the is a suggested choice to the EB-5 visa.

The Only Guide for Eb5 Immigrant Investor Program

Unlike EB-5, Gold Card financiers do not require to create work. Similar to EB-5, it might eventually lead to United stateworkers within two years of the immigrant investor's admission to the United States as a Conditional copyright. The investment requirement of $1 million is lowered to $500,000 if an investment is made in a Targeted Employment Area (TEA).